Student Loan Rules Are Changing in 2026 — and Waiting Could Cost You

Student loan rules don’t usually change all at once.

They inch forward. Quietly. With footnotes and FAQs most borrowers never read.

2026 is different.

A new law already on the books rewrites how federal student loans work — how much you can borrow, how you repay, and how much flexibility you’ll actually have when things don’t go according to plan. Most of the changes take effect July 1, 2026, and once they do, there’s no going back to the old system.

If you’ve ever assumed you’d “figure it out later,” this is the moment when that assumption breaks.

Why 2026 Actually Matters

This isn’t a cleanup of existing programs. It’s a narrowing.

Going forward, borrowers face fewer repayment options, tighter borrowing limits, and hard transition deadlines. The system is moving away from pause buttons, workarounds, and retroactive fixes. In their place is a framework that expects borrowers to commit early — and live with those decisions.

When policymakers say they’re simplifying student loans, what they really mean is reducing choice.

The Graduate PLUS Program Is Ending — and the Gap Reopens

For years, Graduate PLUS loans quietly filled the gap between federal loan limits and the real cost of graduate and professional school. That gap is reopening.

For any new borrowing after July 1, 2026, Graduate PLUS loans are eliminated. Borrowers who already took out a federal Direct Loan before that date, while enrolled in their program, may be allowed to keep borrowing — but only temporarily. In most cases, that window lasts up to three academic years or until program completion, whichever comes first.

This hits professional programs hardest — law, medicine, dentistry, clinical psychology — and it hits career changers especially hard. Schools are not required to lower tuition, and many won’t. In practice, the missing funding often shifts directly to private lenders.

Timing now matters. Not just when you enroll, but when you actually borrow.

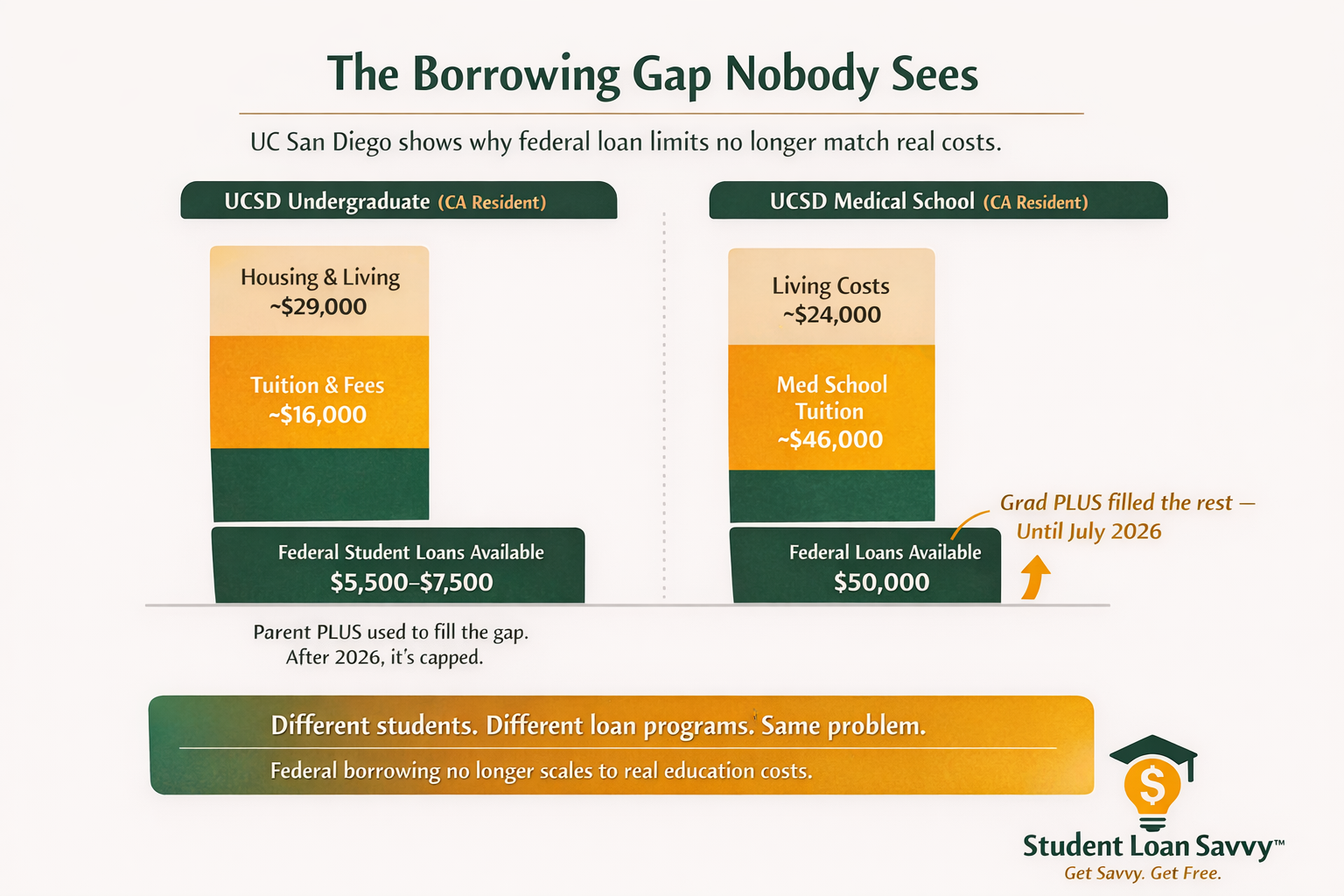

Federal Loan Limits vs. Real Tuition: What the Numbers Look Like at UC San Diego

Graduate and professional students can still borrow through the Direct Unsubsidized Loan program, but the limits are far lower than most people expect.

For graduate students, borrowing is capped at $20,500 per year, with an aggregate limit of $100,000. Professional students are allowed more — $50,000 per year and $200,000 total — but even those limits fall short quickly.

Take UC San Diego School of Medicine as a real-world example.

For the 2025–26 academic year (a reasonable proxy for 2026):

Medical school tuition and mandatory fees run roughly $46,000 per year for California residents

Out-of-state medical students pay closer to $58,000 per year

Once housing, insurance, books, and living expenses are included, total cost of attendance approaches $68,000–$70,000 per year for in-state students, and $80,000+ for non-residents

Even at a public medical school, tuition alone can nearly consume the entire $50,000 annual federal loan limit for professional students, before a single dollar goes toward rent or groceries.

Layer on the new $257,500 lifetime federal borrowing cap (excluding Parent PLUS loans borrowed on a student’s behalf), and it becomes easy to see how borrowers in extended training or multiple graduate programs can hit the ceiling before finishing.

That’s not an oversight. It’s the design.

Parent PLUS Loans Are No Longer the Unlimited Backstop

Parent PLUS loans have long functioned as the safety valve when everything else fell short. That role is shrinking.

Beginning July 1, 2026, Parent PLUS borrowing is capped at $20,000 per year per dependent student, with a $65,000 lifetime limit per student, regardless of how much has been repaid or forgiven. Parents who started borrowing before that date may retain access temporarily, but unlimited borrowing is effectively over.

This matters even at the undergraduate level.

At UC San Diego, undergraduate tuition and mandatory fees for California residents are roughly $16,000 per year. Once housing and living expenses are included, the total cost of attendance commonly lands in the mid-$40,000 range. For out-of-state undergraduates, tuition alone approaches $50,000 per year, before room and board.

For families who previously relied on Parent PLUS to fill that gap, the math looks very different after 2026.

Repayment Gets Much Simpler — and Much Tighter

For loans originated on or after July 1, 2026, repayment choices collapse into just two options: a new Standard repayment plan or the Repayment Assistance Plan, known as RAP.

That’s it.

SAVE, PAYE, ICR, graduated, and extended repayment plans won’t be available for new loans. Future borrowers won’t be choosing among a menu of options — they’ll be choosing between two fundamentally different repayment philosophies.

RAP Stabilizes Balances — It Doesn’t Guarantee Savings

RAP is an income-based plan, but it’s not SAVE under a new name.

Payments range from 1% to 10% of adjusted gross income, with a $10 minimum payment. Any interest that accrues but isn’t covered by the monthly payment is waived, preventing negative amortization. If a payment doesn’t reduce principal by at least $50 per month, the Department of Education can credit the difference toward principal.

RAP runs for 30 years and has no cap on payments. High earners can end up paying more than they would under a standard plan. Lower earners may benefit from balance stability, but at the cost of a much longer repayment horizon.

RAP is designed to prevent balances from spiraling — not to minimize total dollars paid.

The 2028 Deadline Most Borrowers Aren’t Watching

If you’re currently on SAVE, PAYE, or ICR, there’s another date that matters just as much as 2026: July 1, 2028.

By then, borrowers must transition into a new plan or be automatically and permanently placed into RAP. This is where consolidation timing becomes critical.

Loans consolidated on or after July 1, 2026 are only eligible for RAP or the new Standard plan. Loans consolidated before that date retain legacy treatment and flexibility through the transition period. Once consolidation happens under the new rules, those older options don’t come back.

The day you consolidate now determines which repayment universe you live in.

The Student Loan Savvy Take

Student loan planning used to be reactive. You borrowed first and figured it out later.

After 2026, that stops working.

When undergraduate federal loans top out at $5,500–$7,500 per year, when parents are capped at $65,000 per child, when graduate students lose Graduate PLUS, and when professional students face lifetime caps, planning early isn’t optional — it’s protective.

The borrowers and families who understand these limits early will still have choices. Everyone else will be choosing from what’s left.

That’s why Student Loan Savvy™ exists: to help you make these decisions with eyes wide open, before the window closes.

Not sure how these changes affect you?

Schedule a Student Loan Strategy Session and get clarity on your loans, your options, and what to do next — before the rules change.